EU omnibus proposals, published on 26 February 2025, would result in significant changes to the scope and substance of the CSRD as outlined in this article. For details and analysis of proposed changes, visit our article here.

In brief

- The CSRD significantly expands the non-financial reporting obligations of in-scope undertakings compared to the previous Non-Financial Reporting Directive (NFRD).

- It also applies to a far wider range of undertakings, including non-EU based companies and parent companies of groups with significant operations in the EU.

- Such companies would be wise to seek advice on the potential application of CSRD to their businesses and their readiness to comply with the associated European Sustainability Reporting Standards (ESRS).

- Working in collaboration with Good Business, there are many ways the Mishcon Purpose team can help, from designing and delivering double materiality assessments to drafting compliant disclosures.

What is the intent of the CSRD?

Entering into force on 5 January 2023, the CSRD aims to advance the scope and quality of corporate sustainability reporting. Significantly amending and extending the non-financial reporting requirements under the previous NFRD, it requires in-scope undertakings to report on a wide range of environmental, social and governance (ESG) matters, in accordance with the ESRS.

What are the ESRS?

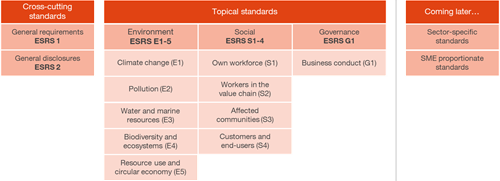

Currently consisting of two cross-cutting standards and ten sector-agnostic topical standards, the ESRS define what and how in-scope undertakings must disclose. They include mandatory principles to be applied when reporting, how disclosures should be prepared and presented, and the minimum disclosure requirements in relation to material topics.

Figure 1: ESRS standards

To whom does the CSRD apply and when does it take effect?

Whereas the NFRD applied to around 11,000 companies, it's been estimated that the CSRD will apply to some 50,000 companies. This includes companies and parent companies of groups that are based outside, as well as inside, the EU. Whether or not an undertaking finds itself in scope of the CSRD depends on a variety of factors that should be assessed on a case-by-case basis, but in summary:

- Large EU public interest companies or parent companies of groups that were already subject to the NFRD (i.e., listed companies with more than 500 employees) must report in accordance with the ESRS from 2025, for financial years starting on or after 1 January 2024.

- Other large EU companies or parent companies of groups (satisfying at least two of: more than 250 employees, more than €50 million net turnover or a balance sheet total of more than €25 million) must report from 2026, on financial years starting on or after 1 January 2025.

- EU listed small medium enterprises (except micro undertakings), small and non-complex credit institutions, and captive insurance undertakings must begin reporting from 2027, on financial years starting on or after 1 January 2026.

- The reporting requirements of the three groups above also apply on the same basis to non-EU companies listed on an EU regulated market.

- Subject to other requirements (an EU branch with more than €40 million net turnover, or at least one EU subsidiary meeting any of the criteria above), non-EU companies or parent companies of groups with net EU turnover of more than €150 million must report, at the group level, from 2029 on financial years starting on or after 1 January 2028.

Five key things to know

- Double materiality: the CSRD mandates a double materiality approach to the identification and assessment of impacts, risks and opportunities. This means that undertakings must make disclosures not only in relation to how sustainability matters affect their business, but also how their business activities impact society and the environment.

- Beyond direct operations: that process of double materiality assessment extends to value chain arrangements. This means that undertakings are required to disclose not only material impacts, risks and opportunities arising from direct operations, but also from direct and indirect business relationships in the upstream and downstream value chain.

- Stakeholder engagement: the CSRD implies a much wider and deeper process of stakeholder engagement, not only amplifying the need for meaningful engagement with affected communities, but also addressing the extent to which stakeholders are consulted in formulating and assessing the sufficiency of an undertaking's polices, actions and targets.

- Integrated reporting: the CSRD requires that disclosures are incorporated in a dedicated section of the undertaking's annual report, and that they are subject to limited assurance (i.e., evaluated by an independent auditor).

-

Implications for multinationals: for non-EU parent companies of groups that generate turnover of at least €150 million in the EU, and maintain at least one subsidiary or branch office in the bloc, there may be no obligation to report at the group level until 2029. However, it's worth noting the exemption from sustainability reporting requirements for subsidiaries that are included in their parent company's consolidated management report. For parent companies with multiple EU subsidiaries in scope of the CSRD, this could mean there is a case for earlier adoption of consolidated reporting.

How can we help?

Working in collaboration with leading sustainability consultancy, Good Business, the Mishcon Purpose team offers a variety of services to help you assess the applicability of the CSRD to your business, and to prepare for and produce ESRS-compliant disclosures. These include:

- Conducting CSRD readiness assessments.

- Designing stakeholder engagement.

- Designing and delivering double materiality assessments.

- Conducting impact mapping and analysis.

- Developing ESRS-compliant disclosures and reporting structures.

- Providing associated policy and governance advice.

Clients who've already benefitted from our joint approach include a global online delivery business, seeking help with CSRD-compliant environmental disclosures and policies, and a UK property company wishing to apply a double materiality assessment process to help confirm and refine its ESG priorities in relation to a major office redevelopment.

To discuss your needs, get in touch to arrange a free 30-minute consultation.