In brief:

- Double materiality requires that companies assess and disclose not only how sustainability issues affect their business, but also how their business activities impact society and the environment.

- Already core to new mandatory disclosure requirements under the EU Corporate Sustainability Reporting Directive (CSRD), it's also central to new guidelines published in China last month.

- As a result, double materiality is arguably set to become the de facto global norm for sustainability reporting, meaning that companies would be wise to prepare for and adopt it, whether or not they are in scope of mandatory requirements.

- For more information, including practical insights on application of a double materiality approach, register for a special double materiality breakfast briefing, co-hosted by Mishcon Purpose and Good Business on 2 April 2024.

What is double materiality?

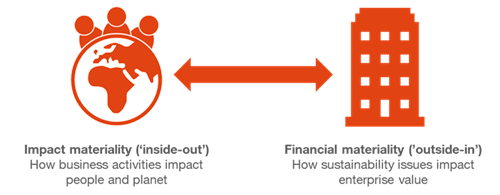

Materiality assessment describes the process by which companies identify, prioritise and report on the sustainability issues that matter most to their business. Historically, this has been singularly focused on financial materiality – i.e., an 'outside-in' perspective concerned with how sustainability issues, such as climate change, may affect enterprise value. However, double materiality takes the concept of materiality a step further by adding a focus on impact materiality – i.e., an 'inside-out' perspective requiring identification and assessment of the ways in which business activities actually or potentially impact people and the environment (see definitions below).

Considered key to providing a more complete picture of companies' sustainability progress and performance, application of a double materiality approach has many important implications, including:

- Expanding the range of material issues: a sustainability topic may be material from an impact perspective only, from a financial perspective only, or from both perspectives.

- Extending the boundary of reporting: whereas assessment of financial materiality only tends towards a focus on direct operations, the addition of impact materiality necessarily extends to covering the entire value chain, since this is where most outbound risks and impacts typically reside.

- Driving strategic integration: because required disclosures include how material issues arise from – and may require adaptation of – business models and value chains, this increases the need for businesses to expressly consider sustainability risks, opportunities, dependencies and impacts in the development of corporate strategy.

- Bridging data gaps: a key barrier to deeper integration is the availability of robust data, particularly pertaining to risks and impacts along the value chain. According to a recent study, only 28% of executives report having high quality sustainability data and 59% foresee difficulties in complying with the CSRD [1]

Impact and financial materiality definitions in the European Sustainability Reporting Standards (ESRS):[2]

| Impact materiality |

“A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long term. [This] includes impacts caused or contributed to by the undertaking and impacts which are directly linked to the undertaking’s own operations, its products, and services through its business relationships. Business relationships include the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.” |

| Financial materiality |

"A sustainability matter is material from a financial perspective if it triggers or may trigger material financial effects on the undertaking’s development, including cash flows, financial position and financial performance, in the short-, medium- or long-term. This is the case, in particular, when it generates or may generate risks or opportunities that significantly influence or are likely to significantly influence its future cash flows. Future cash flows, together with other critical factors such as business model, strategy, access to finance and cost of capital, are likely to influence the financial position and financial performance of the undertaking in the short-, medium- or long-term.”

|

Where and for whom will double materiality be mandatory?

Double materiality assessment is already core to new mandatory disclosure requirements under the CSRD. These start to take practical effect from next year (see CSRD timeline below) and have been estimated to directly impact around 50,000 companies.

Last month, China also published draft guidelines for standardising listed companies' disclosure of information related to sustainable development. [3] Expected to affect more than 450 companies, these new obligations are scheduled to take effect from 2026 (covering the 2025 reporting period) and, like the CSRD, they also stipulate a double materiality approach to reporting.

Across a broad range of environmental, social and governance (ESG) categories – including climate change and energy use, ecosystem and biodiversity protection, and circular economy and supply chain security, among others – companies will be required to disclose information spanning four 'core content' topics, which closely match those of the ESRS general disclosure requirements, i.e.:

- Governance: the company's governance structure and internal systems for managing an overseeing sustainability-related impacts, risks and opportunities.

- Strategy: the company's strategy, tactics and methods for addressing material impacts, risks and opportunities.

- Impact, risk and opportunity management: the measures and processes used by the company to identify, assess, monitor and manage sustainability-related impacts, risks and opportunities.

- Indicators and objectives: indicators and objectives used by the company to measure, manage, supervise and evaluate its response to material impacts, risks and opportunities.

CSRD timeline

Obligations to report in line with the ESRS will take effect in four phases:

- 2025: large EU-listed companies, banks and insurers with more than 500 employees (those already subject to the previous Non-Financial Reporting Directive regulation) must report on fiscal year 2024

- 2026: other large EU-incorporated companies (those satisfying two or more of: over 250 employees; over €50m annual revenue; over €25m in total assets) must report on fiscal year 2025

- 2027: EU-listed SMEs must report on fiscal year 2026

- 2029: Companies whose ultimate parent lies outside the EU, but which have at least one EU branch/subsidiary and generate annual EU revenues of more than €150m, must report on fiscal year 2028 for the whole group (including non-EU group companies)

What may be the wider significance of these developments?

Publication of the Chinese guidelines adds to the general trend towards mandatory sustainability disclosure requirements across multiple jurisdictions, including those introduced by the CSRD in the EU, as well as new US SEC's climate disclosure rules, and the UK Sustainable Disclosure Regulation (SDR) expected for publication later this year.

More significantly, though, China and the EU cumulatively account for close to 35% of global GDP (vs. 25% for the US and 3% for the UK). Together with the reality that multinational corporations will have to operate within the framework of the most progressive regulator, this means that China and the EU's alignment on a double materiality approach could well establish this as the de facto global norm.

Since this will ultimately affect what investors and other stakeholders are looking for from any company, large or small, companies would be wise to prepare for and adopt a double materiality approach, irrespective of whether they are in scope of regulations mandating it.

At the very least, standardising on double materiality offers a means to cut through the complexity of different regulatory standards across different jurisdictions. In an era marked by the rising threat of social and ecological collapse, it's also general good practice for companies to invest in better understanding their social and environmental impacts, and how their actions affect the people, resources and ecosystem services they rely upon to function. This is foundational to assessing the resilience of current business models, and to informing the development of overall strategy and governance structures that preserve a company's ability to create and sustain value over time.

Want to learn more?

To explore these trends further, as well as to highlight insights from practical application of a double materiality approach, Mishcon Purpose and Good Business are joining forces to deliver a double materiality breakfast briefing on 2 April 2024. The event will be held at Mishcon's Africa House office from 8.30am to 10.30am. If you'd like to attend, you can register here.