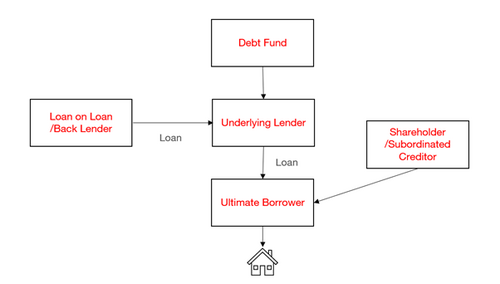

Loan-on-loan structures (and, in some cases, loan-on-loan-on-loan structures) are becoming increasingly popular in the real estate finance market; with debt funds using these arrangements to reduce their exposure to the ultimate borrower and boost returns. Commercial lenders, meanwhile, are keen to tap into the real estate market without lending directly to the ultimate borrower.

Whilst enthusiasm for these structures remains high, we take a look at some key considerations for lenders.

Due diligence

Back lenders typically rely on the underlying lender's due diligence on the ultimate borrower and the real estate assets, particularly where the ultimate borrower is unaware of the loan-on-loan arrangements. Reports on title, legal opinions, surveys, valuations and other reports are usually disclosed to - and ideally relied on by - the back lender.

Due diligence on the finance documents and security package between the underlying lender and the ultimate borrower is also essential. These documents should permit the underlying lender to grant security over them in favour of the back lender and transfer any of its rights and obligations (or assign any of its rights) to the back lender. Confidentiality provisions should be carefully reviewed to ensure that the underlying lender may disclose information relating to the underlying loan.

Recourse to underlying lender and insolvency risk

A key consideration for lenders will be the extent to which the back lender has recourse to the underlying lender's assets or its parent fund (particularly where the underlying lender is an SPV). Generally, these deals are structured on a limited recourse basis so that the back lender's loan is only secured against the underlying lender's interest in the loan to the ultimate borrower.

Attention should also be given to the capital stack. Where the underlying lender has other debt facilities, the back lender will need to assess its priority in an insolvency scenario (especially if its security does not extend to all of the underlying lender’s assets). The back lender is therefore likely to require that other creditors are fully subordinated.

Covenant control

Covenant control is often heavily negotiated. The back lender will require some influence over the underlying lender and, indirectly, the ultimate borrower. For example, they may insist on veto rights or the ability to direct the underlying lender in relation to material waivers or consents. Striking the right balance between the underlying lender's need to retain flexibility to make decisions in relation to its borrower and the back lender's desire for control can be tricky. This will be especially relevant on transactions where the ultimate borrower remains in the dark about the back leverage arrangements.

Security considerations and confidentiality

The approach to security can determine whether the ultimate borrower becomes aware of the loan-on-loan. An equitable assignment of the finance and security documents may be taken without the ultimate borrower's knowledge, provided there are no borrower consent provisions in those documents. However, a sub-charge required by the back lender and registered against the title of the property will require the ultimate borrower's consent on day one.

Agency rights may become a sticking point where the underlying lender is also acting as security agent. Back lenders are likely to require a signed but undated agent resignation letter or may insist that an independent security agent is appointed from the outset.

Step-in rights

In an enforcement scenario, the back lender will usually want the ability to "step into the shoes" of the underlying lender. This is typically achieved by assigning the facility and security documents, with back-to-back events of default, so that an event of default under the underlying loan triggers an event of default under the loan-on-loan. Whether a legal assignment is taken at drawdown will depend on the underlying lender's willingness to share the back leverage arrangements with the ultimate borrower.

Conclusion

Loan-on-loan arrangements require thorough due diligence and careful structuring. Understanding and engaging with the key issues from the outset helps ensure that appropriate documentation can be put in place, meeting the requirements of both the back lender and the underlying lender, and avoiding complications further down the line.