The latest edition of our "UK regulatory roadmap" identifies key upcoming and ongoing regulatory developments impacting the betting and gaming sector.

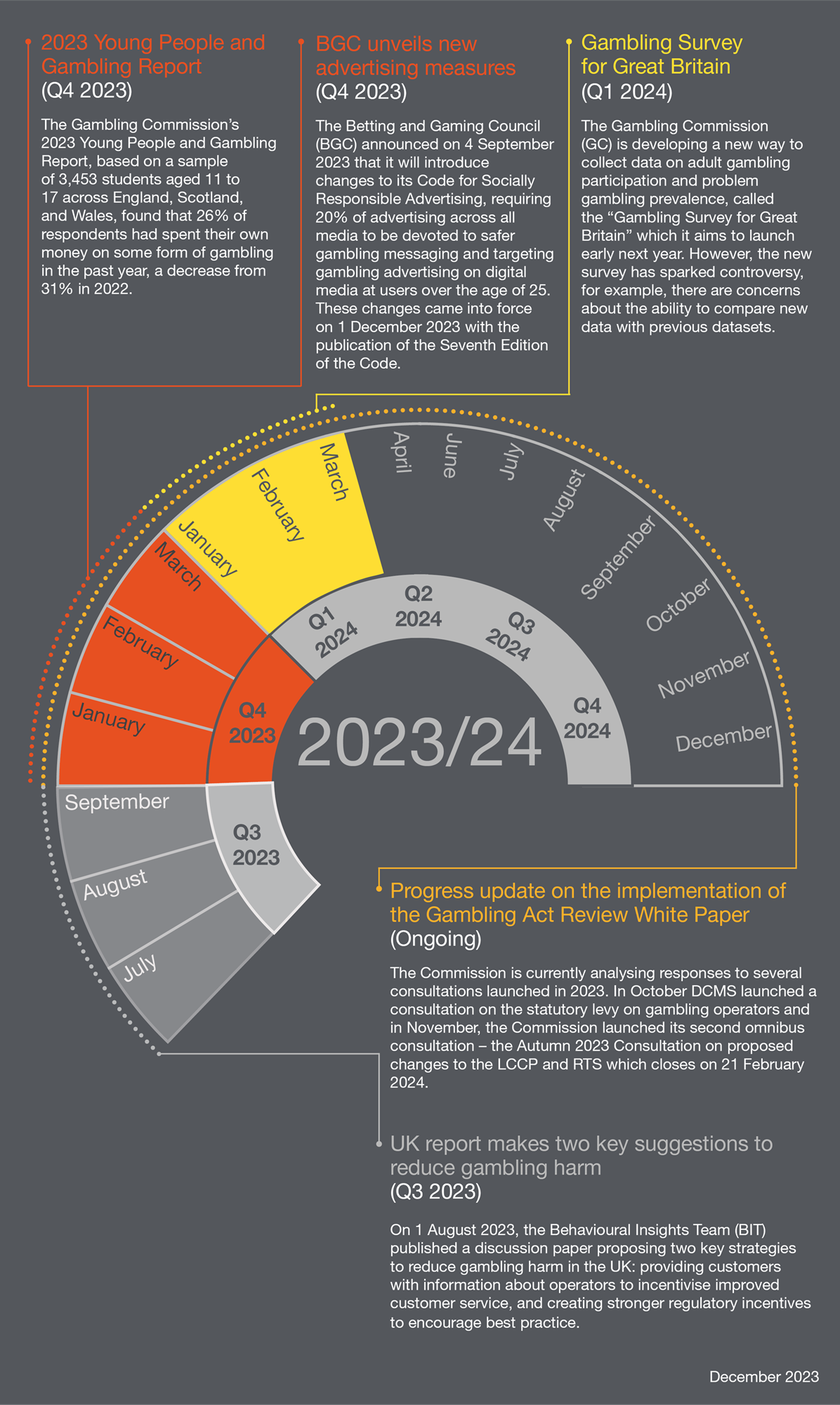

Progress update on the implementation of the Gambling Act Review White Paper (Ongoing)

On 25 September 2023, Tim Miller, Executive Director of the Gambling Commission (the "Commission"), delivered a speech at the 'Regulating the Game' conference, providing updates on the progress made in implementing the Government's Gambling Act Review White Paper.

The speech focused on ongoing work, potential areas of contention, future plans, non-consultation deliverables, and the role of the Commission in supporting and scrutinising the work of others responsible for delivering changes in gambling regulation. The speech can be read in full here.

Mr Miller acknowledged industry concerns that providing substantive and constructive submissions to consultations requires time and resources, especially whilst working with the Commission on the results of the last round of consultations. However, he expressed the view that this timeline is achievable and enables the Commission to strike a balance between executing the White Paper recommendations and accommodating the input of stakeholders it seeks to include in the consultations.

Mr Miller was unable to provide an indication of when the Commission would be able to review and respond to the responses to the first set of public consultations launched in July 2023. In late November 2023, the Commission stated that it was currently analysing those consultation responses, and would 'set out one or more responses to this consultation in 2024'.

In July, DMCS launched a consultation on maximum stake limits for online slots games as well as one on measures relating to the land-based gambling sector, both of which closed in October. This was followed later in October by DCMS launching a consultation on the statutory levy on gambling operators.

On 29 November 2023, the Commission launched its second omnibus consultation – the Autumn 2023 Consultation on proposed changes to the LCCP and RTS. This covers:

- socially-responsible incentives: (i) ensuring that free bets and bonuses do not encourage excessive or harmful gambling; (ii) restricting or banning the use of wagering requirements; and (iii) banning the mixing of product types (e.g. betting, bingo, casino and lotteries) within incentives

- customer-led tools: making it easier for customers to use self-help tools such as deposit tools with the minimum of friction

- customer funds: where funds are not protected in the event of operator insolvency, imposing requirements for this to be brought to the attention of customers more prominently

UK report makes two key suggestions to reduce gambling harm (Q3 2023)

On 1 August 2023, the Behavioural Insights Team ("BIT"), a consultancy that works with governments to tackle policy problems, published a discussion paper which presented two key ideas to reduce gambling harm in the UK gambling market.

The BIT research contends that the UK gambling market fails to sufficiently incentivise operators to mitigate the harms associated with gambling, except in extreme cases. The research suggests that a well-designed market would align operator incentives with improving consumer welfare and well-being.

Applying pressure on operators by sharing information about them with other stakeholders

The BIT proposes providing customers with information such as which operators have the highest customer service rating to "encourage customers to spend more money with those operators, incentivising all operators to improve their customer service".

Creating stronger regulatory incentives to encourage best practice

Regarding regulatory incentives to encourage best practices, the BIT recommends that "establishing explicit guidelines and measurable outcomes enables the regulator to oversee operator performance effectively. Performance can be linked to incentives, such as penalties, fines, or other regulatory measures, to further motivate operators to prioritise consumer interests."

The BIT's view is that a combination of both approaches is likely to be most effective.

The BIT has welcomed feedback on this discussion paper and intends to use it as the foundation of collaborative work with stakeholders across the sector to prioritise next steps for this work. The BIT's goal is to gain further evidence and initiate pilot programs to inform policymakers' decisions on market reform.

Gambling Survey for Great Britain (Q1 2024)

The Commission has historically made use of the NHS’ Health Survey Data along with the quarterly telephone survey. During his appearance in front of the DCMS Select Committee last month, Tim Miller discussed this and some of the reasons the GC are moving towards a new model.

- Both sets of data have been useful, but also have their limitations. The quarterly telephone survey that GC used was a relatively small sample size but allowed GC to track data in more real time. With the NHS Health Survey data, as health is a devolved issue there was some inconsistency across England, Scotland and Wales and because of the time it takes to get through NHS digital, the data was often slightly out of date.

- So the GC are currently working on what they call their "new gold standard" for collection of data on adult gambling participation and the prevalence of problem gambling, which is called the "Gambling Survey for Great Britain".

- This will be the largest survey of its type into prevalence and participation of gambling anywhere in the world with 20,000 responses a year when it is fully up and running.

- The GC say this will give it more accurate and up to date information, leading to better regulation across the sector.

- The GC are currently in fieldwork and will start publishing new data in the Spring of next year.

- With a pilot conducted in full and published last year already, the Gambling Survey of Great Britain will launch early next year.

The new survey has caused some controversy. The GC says on the one hand, those wanting to argue problem gambling is low at between 0.3 percent and 0.5 percent of the population, have also argued the same, sometimes limited, sample sizes mean there is insufficient evidence to support intervention in areas of higher risk. The GC says there is a huge contradiction here, but what is clear is it does need to continue to improve the evidence base, which it says is exactly what this much larger, robust and detailed Gambling Survey of Great Britain will do, with updated questions for the digital age and predictable, regular data for study.

However, if you have a completely new approach then your ability to compare to previous datasets can be lost. The GC says that as it trialled this new methodology and published its approach and initial findings there has been some hostile reactions from those who are concerned over what the new methodology may mean for the headline problem gambling rate as it effectively re-baselines this statistic.

In trials, the overall proportion of problem gamblers in the population was found to be higher. The GC says this is actually just a new baseline and does not mean there are more problem gamblers than before. There GC says there is a thorny issue of how some will still claim an increase, where this is misleading, but also arguments from those who have staked so much on a previous number who simply don’t want to see that number change, but also want to argue against the reason for making changes while relying on the same data set.

The GC says they're now expecting a further update on the progress of this project before it is expanded to cover more operators and more consumers as a result. And it's also finalising its new methodology for collecting Participation and Prevalence data. In particular for problem gambling rates, the GC is clear that better data will lead to better regulation and better outcomes for both consumers and operators as a result.

Industry experts Regulus Partners have critiqued the new survey methodology (commenting that because it relies on a self-selecting sample of respondents, those who choose to respond are more likely to have concerns about problem gambling, thereby resulting in an over-reporting of PG risks when compared to the NHS Health Surveys).

2023 Young People and Gambling Report (Q4 2023)

The Commission has released its 2023 Young People and Gambling Report, which studies the exposure and involvement of children and young people in gambling. The research was conducted in schools across England, Scotland, and Wales, with a sample of 3,453 students aged 11 to 17.

Key findings include:

- 26% of respondents spent their own money on some form of gambling in the last 12 months, a decrease from 31% in 2022.

- 4% of respondents spent their own money on regulated gambling (excluding arcade gaming machines), a decrease from 5% in 2022.

- 0.7% of respondents were identified as problem gamblers, a decrease from 0.9% in 2022.

- 1.5% of respondents were identified as at-risk gamblers, a decrease from 2.4% in 2022.

- 55% had seen gambling adverts offline, a decrease from 66% in 2022, and 53% had seen adverts online, a decrease from 63% in 2022.

The most common types of gambling activity that young people spent their own money on were legal or did not feature age-restricted products, such as playing arcade gaming machines (19%), placing a bet for money between friends or family (11%), and playing cards with friends or family for money (5%).

BGC unveils new advertising measures (Q3 2023)

The BGC announced on 4 September 2023 that it would be introducing changes to the advertising standards contained in its Code for Socially Responsible Advertising (IGRG). These will be published in the Seventh Edition of the Code and will be coming into force on 1 December 2023.

The BGC has stated that this forms part of their wider efforts to drive up standards within the betting and gaming industry and protect those under the legal gambling age from exposure to gambling-related harm (e.g., the whistle-to-whistle ban).

The two key changes:

- 20% of advertising across all media is to be devoted to safer gambling messaging. Previously, this 20% commitment only applied to TV and radio advertising, so it will be extended to include advertising on digital media.

- Gambling advertising on digital media is to be targeted at users over the age of 25. Previously, the BGC could permit gambling operators to target users over 18 on platforms that could provide evidence on the accuracy of their age verification systems.

For further information please read our article on the new advertising rules on digital media.

The changes brought about by the Seventh Edition of the IGRG Code will require operators to ensure that they are including safer gambling messaging in their online adverts, equivalent to a minimum of 20% of the relevant ad.

Operators will also need to ensure that their digital media adverts are targeted at over-25s across all online platforms, regardless of a platform's age verification systems.

This will create some additional steps for operators in the digital media advertising space, reflective of the prevalence of online advertising and its exposure to young people.

BGC Announcement date: 4 September 2023

Entry into force of new IGRG Code: 1 December 2023