The latest edition of our "UK regulatory roadmap" identifies key upcoming and ongoing regulatory developments impacting the betting and gaming sector.

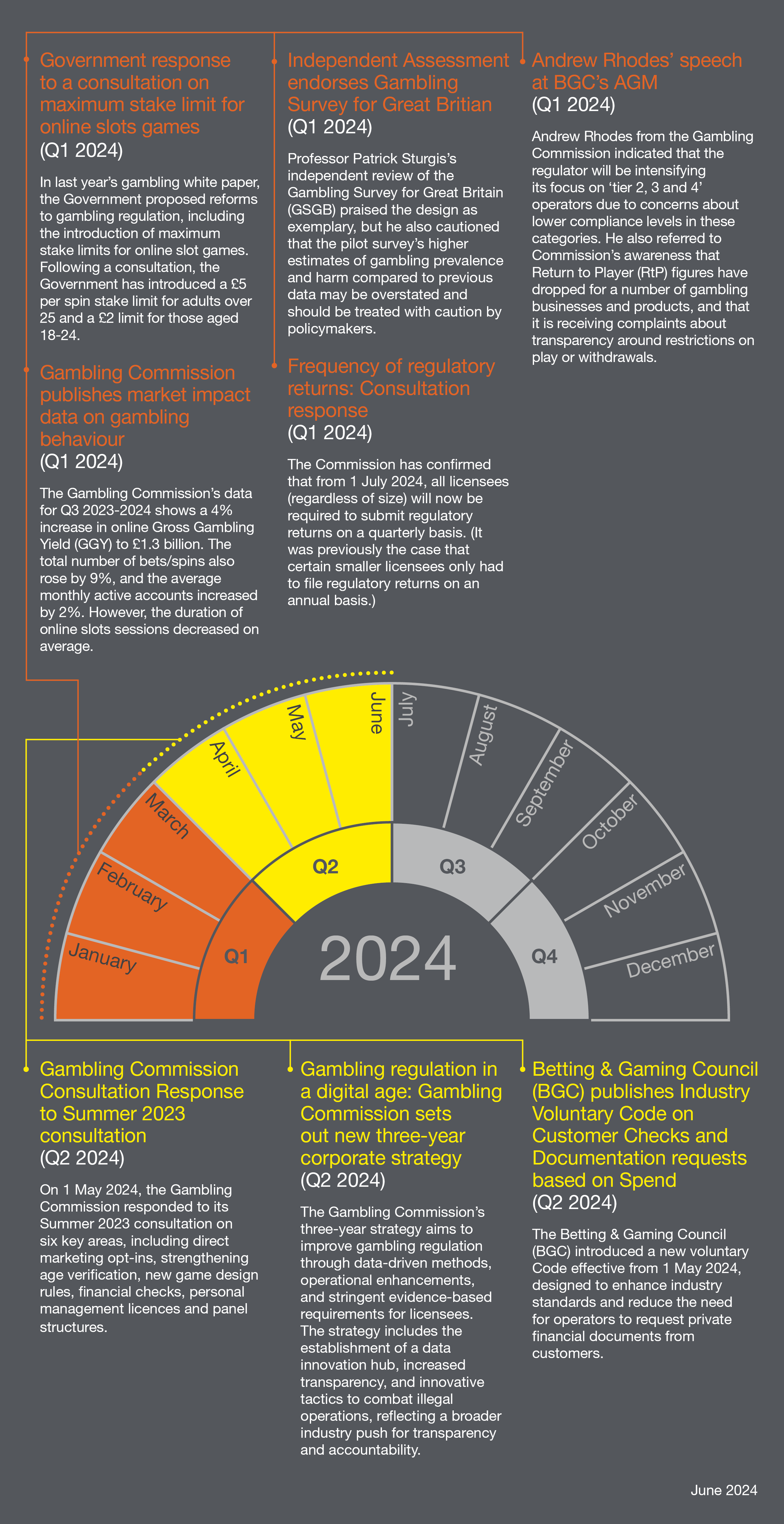

Government response to a consultation on maximum stake limit for online slots games (Q1 2024)

In April 2023, the Department for Digital, Culture, Media & Sport (DCMS) published a white paper outlining the Government's plans to modernise the regulation of the gambling sector.

A key proposal was the introduction of maximum stake limits for online slots games. At present, the absence of limits on stakes in the online slots contrasts with the stake and prize limits imposed on gaming machines in the land-based sector.

The Government consulted on a range of proposals, which it said would align with its objective of regulating the online and land-based gambling sector equitably while addressing the risks associated with high stakes play on online slot games.

The consultation received 98 responses from an array of stakeholders and the Government issued its response on 23 February 2024, in which it settled on the following:

- A maximum stake limit of £5 per spin for adults aged 25 and over; and

- A maximum stake limit of £2 per spin for adults between the ages of 18 and 24.

You can read more about this in our article here.

The introduction of maximum stake limits for online slots has been anticipated for several years, and while the introduction of the £5 limit appears to provide parity with the land-based sector, critics of the change will point towards the enhanced player protections which apply online. Many operators have proactively implemented a host of player safety measures in response to the various consultation proposals flowing from the White Paper, including introducing stake limits. Whilst the main policy objective behind these proposals is to mitigate risk of harm to players, there is widespread concern that the very customers who are most at risk will simply turn to the readily accessible unregulated market. Operators must now focus on implementing the necessary adjustments to comply with the new limits.

Gambling Commission Consultation Response to Summer 2023 consultation (Q2 2024)

On 1 May 2024, the Gambling Commission published its consultation response to its Summer 2023 consultation. This omnibus consultation covered 6 different topics: (a) improving customer choice on direct marketing; (b) strengthening age verification in premises; (c) new game design requirements; (d) financial vulnerability checks and financial risk assessments; (e) personal management licences and (f) changes to regulatory panels.

We can briefly summarise the Commission's consultation response as follows:

Improving Customer Choice on Direct Marketing

All customers (including existing customers) will be required to opt-into receiving direct marketing on a per channel basis and per product basis. The relevant channels will be phone, emails and texts (specific consent for push notifications, post and fax will not be required). The relevant products will be betting, casino, bingo (with an accompanying explanation of what each product category includes). This change will come into force on 17 January 2025, and will apply to new customers immediately. In relation to existing customers, operators will be required to reconfirm marketing preferences with those customers upon first login after the requirement comes into (d)effect. When consent boxes are presented to customers, they must be 'unticked'.

Age verification in premises

From 30 August 2024, licensees will need procedures that require their staff to check the age of any customer who appears to be under 25 years old (rather than under 21 years old, as is currently required).

Game design

From 17 January 2025: there will be a new 5 second speed limit for non-slots games; autoplay will be banned for all online gaming products; operators cannot provide functionality designed to allow player to play more than one game at once (i.e. the operator cannot have functionality designed to allow a customer to play two games of roulette or two games of blackjack at the same time). There are a number of other (less significant) changes.

Financial vulnerability checks (FVCs) and financial risk assessments (FRAs)

FVCs: From 30 August 2024, operators will be required to conduct 'light-touch' FVCs at a threshold of £500 net deposits in a rolling 30-day period. From 28 February 2025, this threshold will be reduced to £150 net deposits in a rolling 30-day period. A FVC check will involve checking publicly-available information (such as whether a customer is subject to bankruptcy orders or has a history of unpaid debts). The Commission has dropped plans for the FVC checks to review an individual’s postcode or job title. Once a FVC check has been conducted, it will not be necessary to conduct another FVC check for 12 months.

FRAs: A pilot will be launched at the end of August 2024 with the UK's largest operators, to test the effectiveness/proportionality of using different types of data.

PML clarifications

The GC will amend the LCCP to clarify that PMLs must be held by a CEO or managing director (or equivalent). It will also be necessary for the Chair of the Board to hold a PML (regardless of whether they are an executive or non-executive chair), unless they are only appointed on a temporary basis. Key individuals with responsibility for AML/CTF must also hold PMLs.

Regulatory Panels

The GC has decided not to proceed with its proposed changes to the composition of regulatory panels.

Gambling Commission publishes market impact data on gambling behaviour (Q1 2024)

The Gambling Commission has released data reflecting how gambling behaviour has changed in Great Britain from Q3 2022-2023 to Q3 2023-2024. The data has been sourced from operators and includes online and in-person activities at Licensed Betting Operators (LBOs).

The data shows a year-on-year (YOY) increase in online Gross Gambling Yield (GGY) for Q3 2023, with a 4% rise to £1.3 billion compared to Q3 in the previous year. The total number of bets/spins also rose by 9%, and the average monthly active accounts increased by 2%. Real event betting GGY increased by 5% YOY to £468 million. Slots GGY increased by 6% YOY to £618 million, and the number of spins increased by 11%. However, the duration of online slots sessions decreased on average. LBO GGY saw a marginal increase of 0.5% to £563 million, despite a 4% drop in total bets and spins.

The data indicates robust growth in the online gambling sector, with particular strength in slots and real event betting. The reduction in average session length for online slots could be indicative of more responsible gambling behaviours or effective interventions by operators to promote safer gambling sessions. The slight increase in LBO GGY, despite a decrease in bets and spins, could point to higher individual bet values or a shift in consumer betting patterns.

Independent Assessment endorses Gambling Survey for Great Britian (Q1 2024)

In February, an independent review of the Gambling Survey for Great Britian was published, carried out by Professor Patrick Sturgis from LSE. He endorsed the survey and called it "exemplary in all respects". To read the full report you can download it here.

While the Gambling Commission referred to the fact that Professor Sturgis had described the process of designing the new GSGB survey as exemplary, they drew less attention to other aspects of his review. The Sturgis review also referred to the fact that the GSGB pilot produced much higher estimates of gambling prevalence and harm than the surveys previously published by Public Health England. He stated that: "Until there is a better understanding of the errors affecting the new survey’s estimates of the prevalence of gambling and gambling harm, policy-makers must treat them with due caution, being mindful to the fact there is a non-negligible risk that they substantially over-state the true level of gambling and gambling harm in the population". Professor Sturgis also recommended that the Gambling Commission take seven further steps to review the accuracy of the GSGB data. The validity of GSGB is likely to come under considerable scrutiny moving forwards.

Gambling regulation in a digital age: Gambling commission sets out new three-year corporate strategy (Q2 2024)

The Gambling Commission has outlined a three-year strategy to enhance gambling regulation, focusing on data-driven approaches, enhancing core operational functions, and clear evidence-based requirements for licensees. This includes proactive measures for a fairer, safer, and crime-free gambling environment, and successful regulation of the National Lottery. The strategy sets out how the Commission will deliver the Government reforms in the gambling white paper. A new data innovation hub will be created, there will be increased transparency and a creative approach taken to disrupting those operating illegally. The Gambling Survey for Great Britain was given as an example of how the Commission aims to embrace new data and intelligence.

Overall, the industry will need to embrace greater transparency and accountability, aligning with the Commission's commitment to a fair, safe, and crime-free gambling environment. The introduction of clear evidence-based requirements for licensees may mean further training is required.

Frequency of regulatory returns: Consultation response (Q1 2024)

On 27 March 2024 the Commission published its consultation response to a (relatively minor) issue which formed part of its wider Autumn 2023 consultation. The Commission has confirmed that from 1 July 2024, all licensees (regardless of size) will now be required to submit regulatory returns on a quarterly basis. (It was previously the case that certain smaller licensees only had to file regulatory returns on an annual basis.)

Andrew Rhodes' speech at BGC's AGM (Q1 2024)

Andrew Rhodes gave a speech at the BGC's AGM on 29 February. He stated that the Commission, over the coming year 'and beyond', will be focusing its casework on 'tier 2, 3 and 4' operators, with its concern being that compliance is lower among these operators.

He also referred to Commission's awareness that Return to Player (RtP) figures have dropped for a number of gambling businesses and products, and that it is receiving complaints about transparency around restrictions on play or withdrawals.

We expect to see heightened levels of enforcement action in respect of small-medium sized operators in the UK.

It is unclear what he considers should happen (if anything) in response to his comments about RtP – he notes only that the Commission is aware of it. He did make clear that the Commission "want to see operators making proper efforts to explain to customers what the checks and restrictions they may face are", and "too many consumers are given the impression that any check they have to go through is linked to affordability". Operators should review the explanations provided to consumers about checks/restrictions and ensure that they are clear and accurate.

Betting & Gaming Council (BGC) publishes Industry Voluntary Code on Customer Checks and Documentation requests based on Spend (Q2 2024)

On 1 May 2024, the BGC published a new voluntary Code which shall operate as an interim scheme with the aim of raising standards while reducing the need for operators to request private financial documents from customers. The Code has been developed jointly with the Gambling Commission and is backed by Government. The Code sets out what actions an operator adopting the Code must take if a customer makes net deposits of more than £5,000 in a rolling month (£2,500 for 18-24 year-olds) and if a customer makes net deposits of £25,000 in any rolling 12-month period.

Under the Code, only customers spending £25,000 or more in any rolling 12-month period may have to provide financial documents to demonstrate they are not at financial risk. It is hoped that by adopting the Code, a degree of consistency will be achieved until such time as the frictionless financial risk assessments outlined in the Government's White Paper, and the Gambling Commission's response to the Summer 2023 consultation, have been piloted and a final decision is made on whether and how these assessments should take place.