The latest edition of our "UK regulatory roadmap" identifies key upcoming and ongoing regulatory developments impacting the betting and gaming sector.

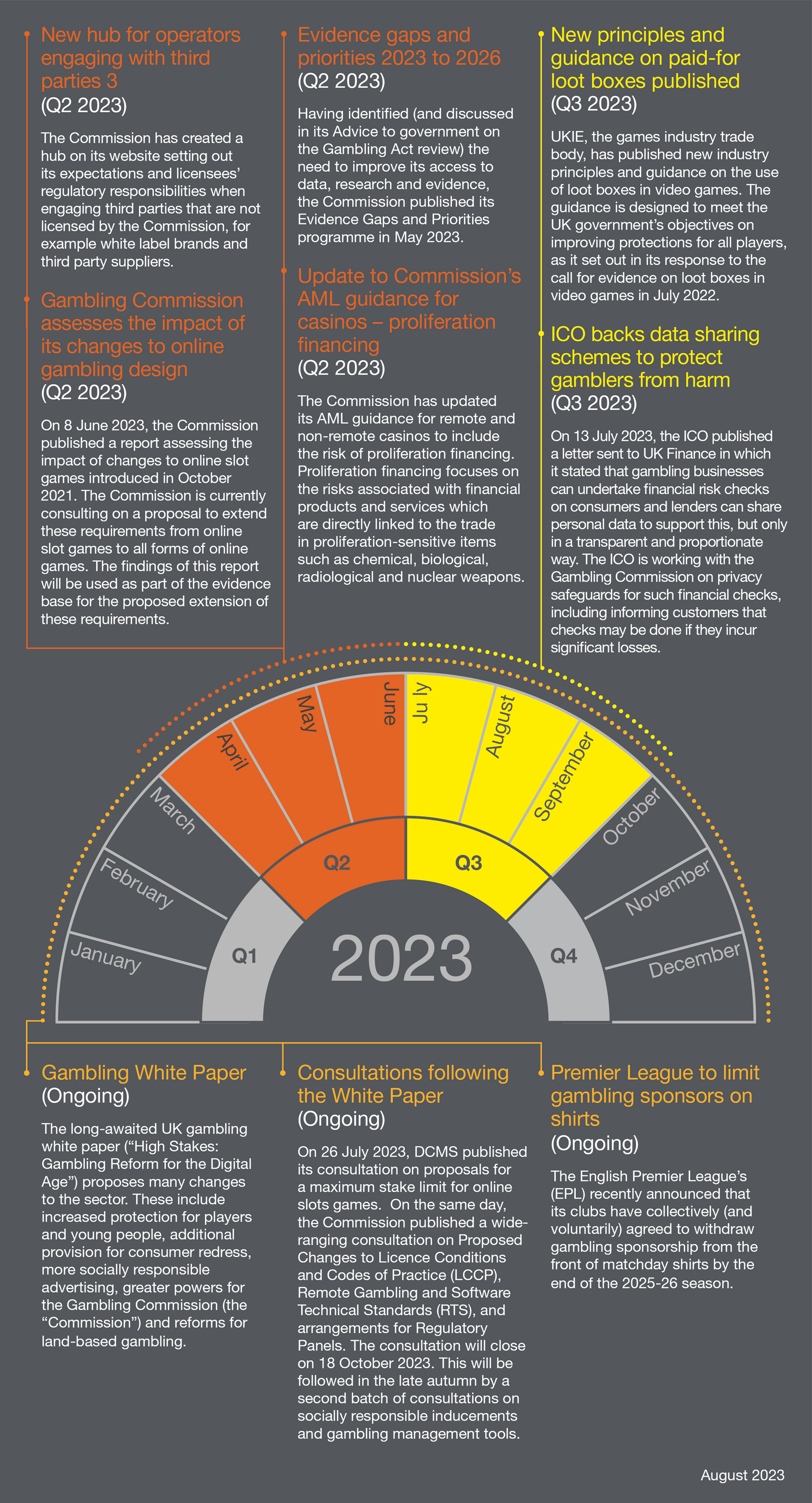

Gambling White Paper (Ongoing)

The long-awaited UK gambling white paper (“High Stakes: Gambling Reform for the Digital Age”) proposes many changes to the sector. These include increased protection for players and young people, additional provision for consumer redress, more socially responsible advertising, greater powers for the Gambling Commission (the “Commission”) and reforms for land-based gambling. See our summary of the key proposals here. Many of the proposals will be developed over the next 12 months through consultation. The Gambling Commission also published the advice it has provided to Government in connection with its review of the Gambling Act 2005. The Commission's advice highlights both recommendations to Government and commitments by the Commission. In June, the All Party Parliamentary Group on Gambling Related Harm (APPG) announced an inquiry into the white paper. This will analyse the white paper proposals as well as provide suggestions for consideration during consultations. The APPG will arrange evidence sessions to examine measures that it feels have been ignored.

We have also written a more in-depth article here, where we analyse the proposals set out in the white paper and review the impact this may have on the industry. Tom Whitton and Sian Harding from Mishcon also feature in the latest issue of the International Masters of Gaming Law magazine (July 2023 edition). Their article, titled "The Gambling Act White Paper: Upping the Ante for the UK Gambling Sector" can be read in full here.

Consultations following the White Paper (Ongoing)

On 26 July 2023, DCMS published its Consultation on proposals for a maximum stake limit for online slots games. This relates to the proposed introduction of a stake limit for online slots games. The consultation sets out four options, namely (a) a maximum online slots stake limit of £2 per spin, (b) £5 per spin, (c) £10 per spin or (d) £15 per spin. In addition, the consultation sets out three options in respect of gamblers aged 18-24, namely that (a) they should be subject to a maximum online slots stake limit of £2 per spin, (b) £4 per spin or (c) they should be subject to the same stake limits as the rest of the adult population. This consultation closes on 20 September 2023.

On the same day, the Commission published a wide-ranging consultation on Proposed Changes to Licence Conditions and Codes of Practice (LCCP), Remote Gambling and Software Technical Standards (RTS), and arrangements for Regulatory Panels. Some aspects of this consultation were foreshadowed in the white paper, namely:

- Proposed changes to the level of consent required for direct marketing, requiring greater granularity of consent for direct marketing in relation to different products (treating betting, casino, bingo and lottery as distinct verticals, each requiring opt-in consent), and well as different marketing channels (for example, requiring opt-in consent for postal marketing, even though this is not required under PECR)

- strengthening age verification in premises, by requiring a wider range of venues to conduct test purchasing, and by indicating that age checks should be conducted on any visitor who appears to be under 25 (the current guidelines indicate these checks should be conducted on anyone who appears to be under 21)

- extending the rules which currently apply to slots games (in relation to the speed and intensity of play) to all online games

- introducing requirements for (a) financial vulnerability checks to be conducted when a player experiences a net loss of £125 in any 30 day period, or £500 in any 365 day period, and (b) for financial risk assessments to be conducted when a player experiences a net loss of £1,000 in any 24 hour period, or £2,000 in any 90 day period.

Alongside the four topics above, the Commission's consultation also covers two further topics that were not referred to in the white paper:

- rules around which roles require a Personal Management Licence to be held

- the composition and decision-making processes of the Commission's Regulatory Panels.

The consultation will close on 18 October 2023. The Gambling Commission stated in a blogpost that will be followed in the late autumn by a second batch of consultations on the following:

- Socially Responsible Inducements

- Gambling Management Tools.

Pre-consultation engagement on these will start in the summer, including gathering data and discussing topics with stakeholders.

The consultations cover some relatively controversial topics, particularly in relation to the so-called 'frictionless' financial risk checks. These consultations are an important opportunity to voice opinions and concerns on proposals in the white paper. We have written an article with advice about how to respond to consultations; to read more about this, please click here.

Premier League to limit gambling sponsors on shirts (Ongoing)

The English Premier League's (EPL) recently announced that its clubs have collectively (and voluntarily) agreed to withdraw gambling sponsorship from the front of matchday shirts by the end of the 2025-26 season. This latest announcement follows consultation between the key stakeholders – the EPL, its clubs and the Department for Digital, Culture, Media and Sport, in the broader context of the UK Government's ongoing review of the current gambling legislation. To read more about this development, including impact, please see the article here.

New hub for operators engaging with third parties (Q2 2023)

The Commission has created a hub on its website setting out its expectations and licensees' regulatory responsibilities when engaging third parties that are not licensed by the Commission, for example white label brands and third party suppliers (see here).

The hub reminds licensees that, pursuant to the LCCP (see Social Responsibility Code provision 1.1.2), licensees are responsible for the third parties that they contract with, and licensees are required to include certain provisions in their contractual terms with third parties, including that such third parties shall conduct themselves as if they were bound by the same licence conditions and subject to the same codes of practice. The Commission also highlighted the importance of conducting due diligence on third parties to ensure that they are suitable, and of ensuring that the licensee has appropriate oversight and control to ensure compliance with the LCCP.

In its announcement of the hub, the Commission warned licensees that, "All operators are reminded [that] the compliance of gambling websites, including white labelled sites, rests with the licence holder and the Commission will continue to closely monitor licensees engaged in these business relationships."

The Commission is concerned about the prominence of white label sites in the British gambling market. Notably, white label partnerships were listed as a high risk in the Commission's risk assessment of money laundering and terrorist financing risks within the British gambling industry. The Commission's reservations with these arrangements were exemplified in the Compliance and Enforcement Report 2019 – 2020, which provided that "there is a concern that unlicensed operators who would potentially not pass the Commission's initial licensing suitability checks, are looking to use the white label model to provide gambling services in Great Britain." However, in its Advice to government on the Gambling Act review, the Commission did conclude that existing controls were sufficient to meet those risks.

The Commission has undertaken enforcement action against licensees for having ineffective policies and procedures in place to conduct due diligence checks on third parties (for example, see the action taken against TGP Europe here).

This new hub implements the Commission's proposal in its Advice to government on the Gambling Act review that it would consolidate good practice information and reinforce its expectations for operators contracting with third parties. However, there is no change to those underlying obligations.

Evidence gaps and priorities 2023 to 2026 (Q2 2023)

Having identified (and discussed in its Advice to government on the Gambling Act review) the need to improve its access to data, research and evidence, the Commission published its Evidence Gaps and Priorities programme in May 2023 (see here).

The programme outlines the Commission's proposals to address the issue for the next three years, to seek to ensure that any regulatory changes are based on an evidence-led approach. The Commission identified the following six key themes to be addressed, which also highlight likely areas of regulatory focus for the coming period:

- early gambling experiences and gateway products (i.e. to understand gambling behaviours of children and young people, and explore their journeys into gambling);

- the range and variability of gambling experiences (i.e. to understand how gambling fits into consumers' lives and daily habits);

- gambling-related harms and vulnerability (i.e. to understand the different ways that consumers experience gambling harms);

- the impact of operator practices on consumer behaviour;

- product characteristics and risk (i.e. to understand which products carry a greater risk of harm); and

- illegal gambling and crime (i.e., to understand the links between crime and gambling, and the impact of the 'black market').

The Commission stated its desire to be a "people focused and evidence-led regulator", which is "constantly studying and delivering ways to improve our data, research and evidence."

It is positive that the Commission intends to ensure that it has the necessary evidence to hand, and that it will allow greater access to its research by making datasets available for wider analysis.

However, the Commission has acknowledged that there are currently gaps in the evidence base informing its decisions policy, which is less than ideal for any regulator and suggests that it may fall back on the "precautionary principle" as a result (more than it might otherwise need to do).

Moreover, this gives rise to concerns that the white paper consultation proposals to be published over the next 12 to 18 months (i.e., before the Commission's programme has concluded) may be based on inadequate evidence. This may culminate in a precautionary set of regulations flowing from the white paper, which may be difficult to revise in the future.

Update to Commission's AML guidance for casinos – proliferation financing (Q2 2023)

The Commission has updated its AML guidance for remote and non-remote casinos to include the risk of proliferation financing. Proliferation financing focuses on the risks associated with financial products and services which are directly linked to the trade in proliferation-sensitive items such as chemical, biological, radiological and nuclear weapons.

The changes include requirements to:

- conduct a risk assessment to identify and assess the risks of proliferation financing;

- implement and maintain policies, procedures and controls to mitigate and manage the risk of proliferation financing;

- involve the nominated officer in establishing the risk-based approach to the prevention of proliferation financing;

- ensure employees make internal reports to the nominated officer where there is suspicion or knowledge that a person is engaged in proliferation financing; and

- implement staff training in relation to proliferation financing.

The updates also incorporate an update to the Money Laundering Regulations, which now include (at Schedule 3ZA) a list of high-risk third countries. As before, operators are obliged (by Regulation 33(1)(b)) to apply Enhanced Due Diligence (EDD) and ongoing monitoring to mitigate the risks arising in any business relationship with a person established in a high risk third country.

Most of the amendments to the guidance serve simply to include the risk of proliferation financing, such that operators must assess and mitigate that risk using the same approach and methodology as they use in respect of money laundering and terrorist financing.

Operators should familiarise themselves with the Treasury's proliferation financing risk assessment in conducting their own risk assessment, and ensure that their business risk assessments, policies, procedures and training are updated to include the risk of proliferation financing.

Operators should also ensure that the list of high-risk countries in schedule 3ZA of the MLRs is incorporated into their CDD processes, such that enhanced due diligence and ongoing monitoring is carried out in respect of business relationships with any customers situated in such countries. Importantly, it should appear in their AML risk assessment and policies.

Gambling Commission assesses the impact of its changes to online gambling design (Q2 2023)

On 2 February 2021, the Gambling Commission announced a ban on four features appearing in online slot games, namely: (a) features that speed up play or give the illusion of control over the outcome; (b) slot spin speeds faster than 2.5 seconds; (c) auto-play - which can lead to players losing track of their play; and (d) sounds or imagery which give the illusion of a win when the return is in fact equal to, or below, a stake. Other new requirements included a requirement to clearly display to the player their total losses or wins and time played during any online slots session These changes came into effect on 31 October 2021.

On 8 June 2023, the Commission published a report assessing the impact of these changes.

Of note, the report evidences that:

- 'play intensity' (measuring session length, losses, staking behaviour etc.) of slot products was marginally reduced despite an increase in the overall popularity of slot products; and

- the percentage of those spending more money playing slot games than they can afford to lose has notably reduced.

Many other metrics within the report - such as levels of trust in gambling providers, simultaneous play and the number of consumer complaints - have either remained statistically stable or are anticipated to be more affected in the long term.

As mentioned above, the Commission is currently consulting on a proposal to extend these requirements from online slot games to all forms of online games. The findings of this report will be used as part of the evidence base for the proposed extension of these requirements.

New principles and guidance on paid-for loot boxes published (Q3 2023)

UKIE, the games industry trade body, has published new industry principles and guidance on the use of loot boxes in video games. The guidance is designed to meet the UK government's objectives on improving protections for all players, as it set out in its response to the call for evidence on loot boxes in video games in July 2022. It was developed by a Technical Working Group convened by DCMS and is comprised of 11 key principles, including giving clear probability disclosures and making available technological controls to restrict those under the age of 18 from acquiring a paid loot box, without the consent or knowledge of a parent, carer or guardian. The government will review the effectiveness of these principles within the next 12 months. For further information please read our article here.

The guidance consists of both requirements for developers to implement – such as greater levels of disclosure and more lenient consumer-facing policies – as well as commitments that the Technical Working Group will pursue.

ICO backs data sharing schemes to protect gamblers from harm (Q3 2023)

On 13 July 2023, the ICO published a letter sent to UK Finance regarding whether financial services companies (such as lenders) can share the personal data of their customers for the purposes of enabling financial risk checks to be carried out by gambling companies. The ICO stated that gambling businesses can undertake financial risk checks on consumers and lenders can share personal data to support this, but only in a transparent and proportionate way. The ICO is working with the Gambling Commission on privacy safeguards for such financial checks, including informing customers that checks may be done if they incur significant losses.

This issue is clearly of importance to the financial services sector, which it is proposed will be involved in the implementation of the new so-called frictionless financial risk checks referred to in the white paper. However, it appears that the ICO has only conducted a high-level review of the issues at this stage, and that the ICO has given little thought to the potential downside risks of the proposed data sharing scheme. This issue will no doubt start to be reviewed more thoroughly as part of the Commission's new consultation on the implementation of these financial risk checks (see above).