Men are, on average, paid more than women - the overall gap currently stands at around 19%. This disparity is due to a number of factors, some of which are outside the control of individual employers. However, working to reduce the gap and create parity between the sexes is not only the right thing to do for businesses, but research shows that closing the gender pay gap would add up to £150bn a year to the UK economy by 2025.

In an attempt to address the issue, in April 2017, mandatory gender pay reporting was introduced for large employers. Under the new rules, employers are required to report on and publish their gender pay gap on an annual basis. Reporting can take place at any time in the year from April but the deadline for the first report to be published is the beginning of April 2018.

This guide will explain the obligations, how to calculate and report the gender pay gap and the importance of the narrative to explain the figures.

Gender pay gap reporting obligations - overview

Large private and voluntary sector employers are required to analyse their gender pay gap each April, and publish a gender pay gap report no later than 4 April 2018. Thereafter, they must produce and publish a report annually.

Large employers are those with 250 or more employees at the "snapshot date" -which is 5 April each year. Employees for these purposes include employees in the traditional sense but also extend to workers who provide their services personally to the employer, so could include consultants and contractors as well as casual workers.

Employers who are covered by the obligations are required to publish the following information:

- Overall gender pay gap figures for relevant employees, calculated using both the mean and median average hourly pay.

- The proportion of men and women in each of four pay bands (quartiles), based on the employer's overall pay range.

- Information on the employer's gender bonus gap (the difference between men and women's mean and median bonus pay over a 12-month period).

- The proportion of male and female employees who received a bonus in the same 12-month period.

- A written statement, signed by an appropriate senior individual, confirming that the published gender pay gap information is accurate.

Employers have the option, and are encouraged, to include a narrative explaining any pay gaps or other disparities, and setting out what action, if any, they plan to take to address them.

Calculating the gender pay gap

The gender pay gap is expressed as a percentage. It is calculated by working out the difference between the average pay of all male employees and the average pay of all female employees, and dividing that number by the average pay of all male employees.

An employer must calculate its gender pay gap using data from a specific pay period every April, starting from 2017, including all "relevant employees" (partners and members of LLPs are specifically excluded). The pay period is defined according to how often the relevant employees are paid; for monthly paid staff, the pay period is one month and for weekly paid staff, the period is one week. The pay period on which the data is based is the pay period within which the snapshot date falls. This means that for monthly paid employees the relevant pay period will be the month of April.

The pay to include for calculation purposes is termed "ordinary pay" in the legislation. This comprises basic pay, paid leave, allowances (like area allowance or car allowance) and shift premium pay. Overtime pay, expenses, the value of salary sacrifice schemes, benefits in kind, redundancy pay, arrears of pay and tax credits should all be excluded. If a bonus is paid in the relevant pay period then this should be included (pro-rated if the bonus refers to a longer period than the relevant pay period).

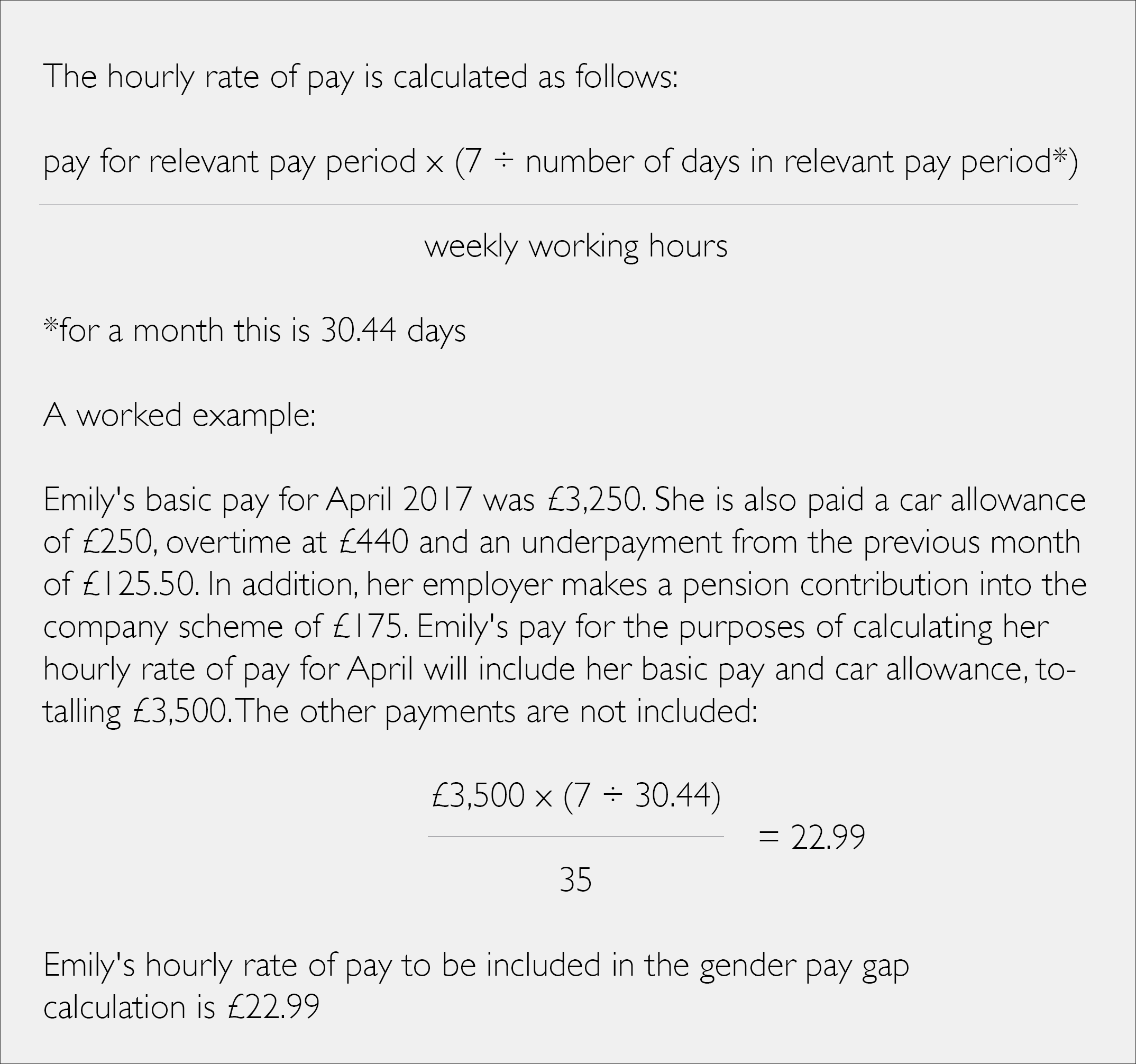

To produce overall gender pay gap figures, employers need to calculate an hourly rate of pay for each employee included in the report. To do so, the employer needs to know what the employee's weekly working hours are. For employees with normal working hours this will generally be the hours set out in their contract. If an employee does not have normal working hours, a weekly average should be calculated by looking back at a 12 week period (using only weeks where the employee has actually completed work) ending on the last complete week within the pay period. The hourly rate of pay is then calculated as shown in the box.

Only full-pay relevant employees should be included in the calculation. This means that any employee who is being paid at a reduced rate or nil as a result of being on adoption, maternity, paternity, shared parental or sick leave or other similar leave should be excluded for the purposes of calculating the gender pay gap (but should be included in the calculation of the bonus gap – see below).

Calculating the gender bonus gap

Bonus pay, which is included in both the headline gender pay gap (albeit on a pro-rated basis if necessary) and the separate gender bonus gap figures, is defined as remuneration relating to profit sharing, productivity, performance, incentive or commission. As well as cash bonuses, securities and options provided under long-term incentive plans (or other similar schemes) are also included. Cash bonuses should be included when the employee actually receives the bonus or award - for example, a bonus awarded because of good performance in 2016 but received in 2017 will need to be factored into the calculations for the 2017 gender pay reporting year. The value of securities should be included at the point at which a taxable charge arises.

When calculating the average bonus pay, all different types of bonus pay that have been received during the 12-month period immediately preceding the snapshot date should be included, expressed as a gross total amount. This may include, for example, sales commission, productivity bonuses and profit shares as well discretionary annual bonuses.

Unlike the gender pay gap calculation, employees on adoption, maternity, paternity, shared parental or sick leave or other similar leave should be included, whether or not their bonus is discounted as a result of being on leave.

Once the bonus figures for the 12 month period have been determined, they should be used to calculate the difference in mean and median bonus pay paid to male and female employees, expressed as a percentage in the same way as the ordinary pay calculations above.

In addition, employers must also show the proportion of male and female employees who received bonus pay during the 12 month period.

Pay quartiles

To identify how the gender pay gap differs across an organisation, at different levels of seniority, employers are required to report on the proportion of men and women in each quartile of their pay distribution.

Using the hourly rate of pay calculated as part of the gender pay gap calculations, employers are required to list each relevant employee in order of their gross hourly rate of pay, from lowest paid to highest paid. The list is divided into four quartiles (pay bands), each containing, so far as possible, an equal number of the organisation's employees. Employers must then report the proportion of male and female employees in each of the lower, lower middle, upper middle and upper quartile pay bands.

Publishing

Employers are required to publish the information on their website in a form that is accessible to employees as well as the public. In addition, the information must be uploaded to a government website.

A senior individual must sign a written statement accompanying the required information, confirming that the gender pay gap information is accurate. For companies or other bodies this will be a director or similar, while for LLPs and partnerships the individual must be a designated member or partner and for other bodies the most senior employee.

The first deadline for publication is 4 April 2018 and annually thereafter. However, employers may choose to publish the information at any time in the 12 months from April.

Enforcement

There is no penalty for failure to comply with the gender pay reporting obligations, however the government will monitor compliance and the public nature of the reporting means that members of the public and prospective employees can check whether an employer has complied. In addition, the government has said that the Equality and Human Rights Commission has power to take action and issue unlawful act notices, though it is doubtful whether the legislation actually gives such power. The threat of bad publicity and the potential effect on reputation are likely to provide the biggest incentive to comply.

Narrative

Transparency is key, but addressing the gender pay gap is about more than just reporting statistics. Employers are encouraged to provide a narrative alongside the gender pay information. Though entirely voluntary, this will provide employers with the chance to put the figures in context and explain the challenges, as well as opportunities, facing the business. The narrative will play an important part in explaining the data, and the steps being taken to address any issues arising, thus minimising the potential impact on reputation, recruitment and retention of a perhaps larger than expected gender pay gap. Along with the narrative, employers are also encouraged to implement an action plan for reducing any pay gap, demonstrating any initiatives that have been put in place or are planned to deal with the disparity.